CMG Stock Overview

Chipotle Mexican Grill (CMG) is a leading fast-casual restaurant chain specializing in customizable burritos, bowls, salads, and tacos. Known for its commitment to fresh, high-quality ingredients, Chipotle has gained significant popularity among health-conscious consumers seeking a fast and flavorful dining experience.

Company History and Mission

Chipotle was founded in 1993 by Steve Ells, who initially opened a small restaurant in Denver, Colorado. Ells’ vision was to create a restaurant that served fresh, high-quality food in a fast-casual setting. The company’s mission statement, “Food With Integrity,” reflects its commitment to using ethically sourced, naturally raised ingredients.

Core Values

Chipotle’s core values guide its operations and culture. These values include:

- Food With Integrity: Chipotle prioritizes using fresh, high-quality ingredients sourced from sustainable farms. They avoid genetically modified organisms (GMOs) and antibiotics in their meat.

- Cultivating a Better World: Chipotle is committed to ethical sourcing practices and supporting sustainable agriculture. They have established partnerships with farmers and ranchers who share their values.

- Respect for People: Chipotle values its employees and strives to create a positive and rewarding work environment. They offer competitive wages and benefits.

- Making a Difference: Chipotle believes in giving back to the community and supporting local initiatives. They have implemented programs to address food waste and promote sustainability.

Business Model and Target Market

Chipotle’s business model is based on providing a fast-casual dining experience with customizable menu options. Their target market is primarily young adults and millennials who are health-conscious, value quality ingredients, and seek convenient and affordable dining options.

Key Products and Services

Chipotle’s menu features a limited selection of customizable items, allowing customers to choose their ingredients and create their own meals. The core menu items include:

- Burritos: Large flour tortillas filled with a choice of protein (chicken, steak, barbacoa, carnitas, tofu), rice, beans, salsas, and other toppings.

- Bowls: Similar to burritos but served in a bowl without the tortilla.

- Salads: Fresh salad greens with a choice of protein, beans, salsas, and other toppings.

- Tacos: Soft corn tortillas filled with a choice of protein, rice, beans, salsas, and other toppings.

Financial Performance

Chipotle has consistently shown strong financial performance, with steady revenue growth and profitability.

Revenue

Chipotle’s revenue has grown significantly over the past few years. In 2022, the company generated $8.6 billion in revenue, a 14% increase from the previous year.

Earnings

Chipotle’s earnings per share (EPS) have also been on an upward trend. In 2022, the company reported EPS of $26.95, up from $20.15 in 2021.

Profitability

Chipotle’s profitability is reflected in its high operating margin. In 2022, the company’s operating margin was 21.7%, indicating strong efficiency in its operations.

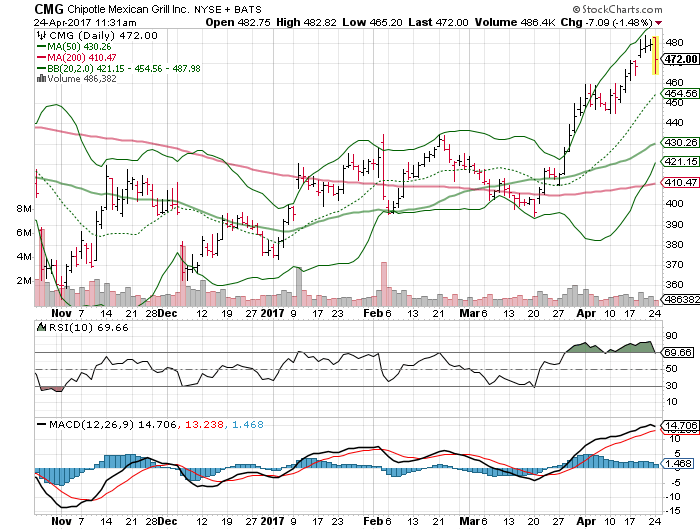

CMG Stock Analysis

CMG stock, representing Chipotle Mexican Grill, navigates a dynamic market landscape influenced by various factors. This analysis delves into the current market conditions, the company’s strengths and weaknesses, and its position within the competitive landscape.

Market Conditions and Impact on CMG Stock

The restaurant industry, including fast-casual chains like Chipotle, faces several challenges and opportunities. Inflation, rising labor costs, and supply chain disruptions are major concerns. However, consumer demand for high-quality, fresh ingredients and convenient dining experiences remains strong. This creates both challenges and opportunities for CMG.

Company Strengths, Weaknesses, Opportunities, and Threats

Chipotle has established itself as a leader in the fast-casual segment. Its focus on fresh ingredients, customizable menu, and commitment to sustainability have resonated with consumers. However, the company faces competition from other fast-casual chains and restaurants offering similar concepts.

Strengths

- Strong brand recognition and loyalty

- Focus on fresh, high-quality ingredients

- Customizable menu catering to diverse dietary preferences

- Digital ordering and delivery capabilities

- Commitment to sustainability and ethical sourcing

Weaknesses

- Higher prices compared to some competitors

- Limited menu options compared to some fast-casual chains

- Operational challenges, including food safety incidents in the past

- Labor costs and staffing shortages

Opportunities

- Expanding into new markets and geographic regions

- Developing new menu items and catering options

- Improving digital ordering and delivery capabilities

- Enhancing customer experience through technology and innovation

Threats

- Increased competition from other fast-casual chains and restaurants

- Economic downturn and consumer spending reductions

- Rising food and labor costs

- Negative publicity or food safety incidents

Industry Trends and their Impact on CMG

The fast-casual restaurant industry is characterized by several key trends. These include the increasing demand for convenience, customization, and healthy options. The rise of digital ordering and delivery platforms has also significantly impacted the industry.

Key Trends

- Convenience: Consumers increasingly value convenience, leading to the growth of delivery and takeout options.

- Customization: Consumers desire personalized dining experiences, with customizable menus and options becoming increasingly popular.

- Health and Wellness: Consumers are increasingly conscious of their health and well-being, driving demand for fresh, healthy, and sustainable food options.

- Technology: Digital ordering, mobile payments, and online ordering platforms are transforming the restaurant industry, enhancing convenience and efficiency.

Competitive Landscape and CMG’s Position, Cmg stock

Chipotle faces competition from various fast-casual chains and restaurants offering similar concepts. These include:

- Qdoba Mexican Eats: A competitor with a similar menu and focus on fresh ingredients.

- Moe’s Southwest Grill: Another fast-casual chain specializing in customizable burritos and bowls.

- Panera Bread: A bakery-cafe chain offering a variety of sandwiches, salads, and soups, with a focus on fresh ingredients and a healthy menu.

- Subway: A global fast-food chain known for its customizable sandwiches and salads.

Comparison of CMG’s Performance with Competitors

Chipotle has consistently outperformed some of its competitors in terms of revenue growth, profitability, and customer satisfaction. The company’s focus on fresh ingredients, customizable menu, and digital capabilities has contributed to its success. However, the company faces challenges in maintaining its competitive edge in a crowded and evolving market.

CMG Stock Investment Considerations

Investing in Chipotle Mexican Grill (CMG) stock presents both potential rewards and risks. Understanding these factors is crucial for informed decision-making.

Risk and Reward Analysis

Chipotle’s stock performance is influenced by several factors, presenting both potential rewards and risks.

- Growth Potential: Chipotle’s strong brand recognition, loyal customer base, and expansion plans offer significant growth potential. The company continues to open new restaurants and explore new markets, which could drive revenue and earnings growth.

- Operational Efficiency: Chipotle’s focus on operational efficiency, including its commitment to fresh ingredients and streamlined operations, can enhance profitability and shareholder value.

- Competition: The fast-casual dining industry is highly competitive, with established players like McDonald’s and Subway, as well as emerging competitors. Chipotle faces challenges in maintaining its market share and profitability amidst this competition.

- Food Safety Concerns: Chipotle has faced food safety issues in the past, which have negatively impacted its reputation and sales. The company’s ability to maintain food safety standards is critical to its long-term success.

- Economic Conditions: Chipotle’s performance can be affected by economic conditions, such as changes in consumer spending and inflation. During economic downturns, consumers may reduce their spending on discretionary items, impacting Chipotle’s sales.

Valuation and Stock Price

Chipotle’s valuation is generally considered high compared to other restaurant companies, reflecting its strong brand, growth potential, and profitability. The stock price is influenced by various factors, including earnings reports, industry trends, and overall market sentiment.

Factors Influencing Future Performance

Several key factors can influence Chipotle’s future performance:

- New Restaurant Openings: Chipotle’s expansion plans, including new restaurant openings and market penetration, will play a crucial role in its growth trajectory. The success of these openings in generating revenue and profitability is essential for shareholder value creation.

- Menu Innovation: Chipotle’s ability to innovate its menu while maintaining its core brand identity is important for attracting new customers and retaining existing ones. Introducing new menu items and flavors while staying true to its commitment to fresh ingredients can enhance customer satisfaction and drive sales.

- Technology Adoption: Chipotle’s adoption of technology, such as online ordering, mobile payments, and delivery services, can enhance customer convenience and drive sales. Its ability to adapt to evolving consumer preferences and technological advancements is crucial for staying competitive.

- Labor Costs: Rising labor costs can impact Chipotle’s profitability, particularly in markets with high minimum wage laws. The company’s ability to manage labor costs effectively while maintaining its commitment to fair wages is essential for sustainable growth.

- Food Costs: Fluctuations in food costs can impact Chipotle’s profitability. The company’s ability to manage these fluctuations through strategic sourcing and menu pricing is crucial for maintaining margins.

Growth Prospects

Chipotle has a strong track record of growth, driven by its brand recognition, customer loyalty, and expansion plans. The company’s focus on fresh ingredients, operational efficiency, and technology adoption positions it for continued growth in the long term.

Comparison to Similar Investments

Here’s a comparison of CMG stock to other similar investments:

| Investment | Valuation | Growth Potential | Risk |

|---|---|---|---|

| CMG | High | High | High |

| MCD | Moderate | Moderate | Moderate |

| YUM | Moderate | Moderate | Moderate |

* MCD (McDonald’s): Offers a more established and diversified business model with a wider global presence. However, its growth potential might be limited compared to Chipotle.

* YUM (Yum! Brands): Operates a portfolio of restaurant brands, including KFC, Pizza Hut, and Taco Bell, providing diversification but potentially lower growth potential compared to Chipotle.

Investors should consider the risk-reward profile of each investment and align their investment strategy with their individual financial goals and risk tolerance.

CMG stock, the ticker symbol for Chipotle Mexican Grill, has seen its fair share of ups and downs. But one thing remains constant: the drive for innovation. It’s no surprise then that the company’s CEO is constantly looking for inspiration, perhaps even taking a cue from the ceo of starbucks , a leader who has built a global coffee empire.

Just like Starbucks, Chipotle is committed to crafting a unique experience for its customers, and that commitment is reflected in the fluctuating but ultimately optimistic trajectory of CMG stock.

CMG stock, the heart of Chipotle’s story, is always a hot topic for investors. But with the recent changes at Starbucks, starbucks new ceo , the fast-casual restaurant industry is watching closely. Will the new leadership at Starbucks impact the competitive landscape and influence how investors see CMG’s future?

It’s a question that only time will answer, but one thing’s for sure, the stakes are high in the world of fast food.